The Takeaway is a periodic blog by Lumira Ventures that covers themes and trends within the fast-growing Canadian healthcare innovation ecosystem. Please note that the views and opinions expressed in this article are those of Lumira Ventures and do not reflect the official policy or position of any of our investors, co-investors, or external partners.

Authors: Nikhil Thatte, Principal and Peter Van der Velden, Managing General Partner

In Part 1, we briefly reviewed the history of Canadian innovation and VC rounds into healthcare companies. Today we continue with how these companies have performed and predict what this means for the ecosystem moving forward.

Opening the Floodgates

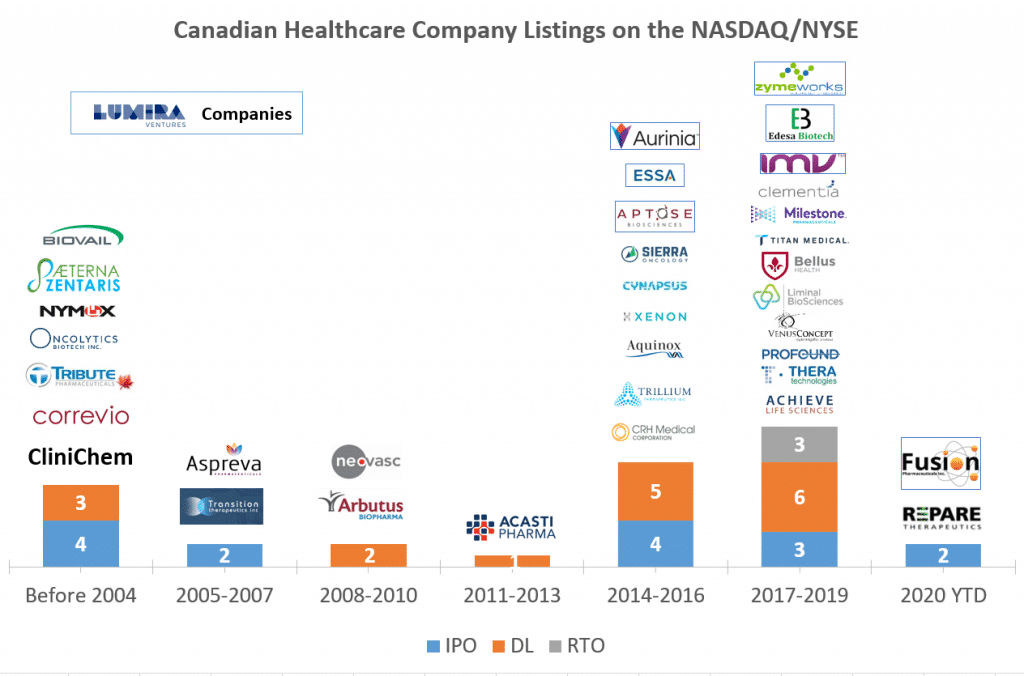

Source: Crunchbase extract of all completed Initial Public Offerings (IPOs) by Canadian-based companies YTD to October 8th, 2020; Public searches for Direct Listing (DLs) and Reverse Takeovers (RTOs). Note direct listing companies may have been listed initially on the TSX or other exchanges but date ranges above reflect the listing dates on the NASDAQ/NYSE.

“Going public” has now become a right of passage for many healthcare companies, particularly for biopharmaceutcal companies, as it provides access to the much broader and deeper pools of capital required to support the continued development of products in the clinic. At the same time, it provides liquidity for early investors, though this often occurs years after the initial access to the public markets. From 2005-2013, there were almost no new Canadian healthcare public listings on the NASDAQ and NYSE. Even then, the very few public listings that did occur in this time like those of Arbutus and Acasti were direct listings with no new capital going in at the time of listing. The lack of activity in this time was undoubtedly a reflection of the VC funding desert that occurred in the Canadian ecosystem from 2001 to 2010.

2014-2016 marked the start of a drastic change from prior years as early stage Canadian healthcare companies, often supported by new VC funding that was enabled in early 2010s (through OVCF, Teralys, and VCAP), had the capital, teams, and investor support to mature into true public candidates. This trend has continued during the last 4 years with an average of 1-2 significant Canadian healthcare IPOs per year. On the direct listing side, many of these early stage Canadian healthcare companies developed on the TSX and the secondary listing on the NASDAQ/NYSE marked a transition to further maturity. For example, Aurinia’s NASDAQ listing followed its merger with Isotechnika and concurrent financing, and similarly Aptose’s NASDAQ listing followed a restructuring and rebranding from Lorus Therapeutics. These dual listings provided companies with investor exposure on both sides of the border. Finally, in a similar vein, RTOs have also emerged over the last 4 years as an alternate path to public markets. Of course, the expectation is that at some time in the future the listing might provide a vehicle for raising capital and as well as optionality for existing investors.

With increasing VC dollars going into Canadian healthcare companies, the growing quality of the leadership teams, and the continuing emergence of best and/or first-in-class innovation from Canada’s academic and medical research centres, one can expect that these IPO trends will likely continue, if not increase, assuming that the bullish public market for healthcare continues. Certainly with 66 healthcare IPOs this year in North America (including Canadian companies Fusion Pharmaceuticals [NASDAQ:FUSN] and Repare Therapeutics [NASDAQ:RPTX]) we are on track to set a record and the tailwinds supporting healthcare investment have never been stronger. But as healthcare investors are well aware, “going public” in the healthcare industry is considered less of an exit per se but rather another and source of capital on the road to full value realization, in the form of more clinical data generation and ultimately bringing a product to market that has the potential to improve patients’ lives.

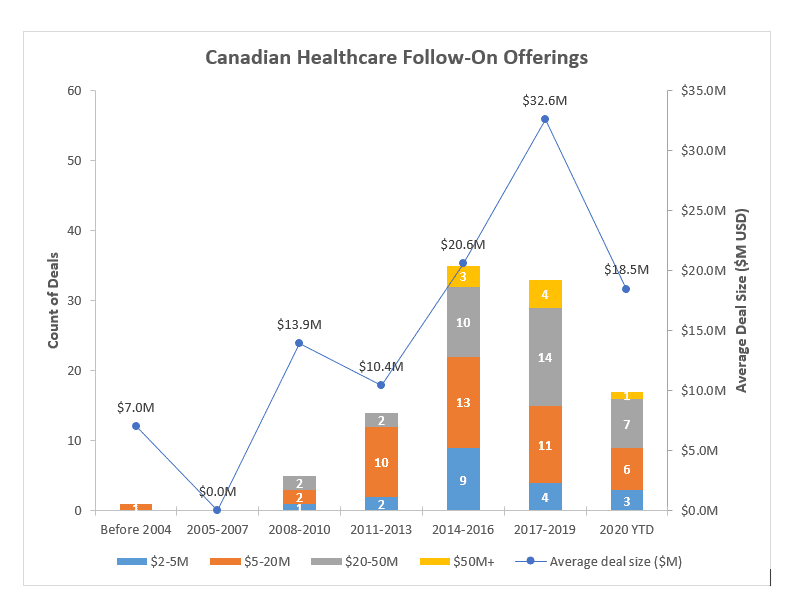

Source: Crunchbase extract of all completed Post-IPO Follow-On Financings >$2M USD by Canadian-based companies YTD to October 8th, 2020 includes therapeutics, medical devices, and digital health.

Canadian healthcare companies have also had better and deeper continuity of capital past public listing. While the number of public equity offerings dropped slightly between 2014-2016 and 2017-2019, the average value of these financings increased significantly, highlighting the depth of capital available for Canadian companies. No company personified this more than Aurinia, who completed two post-IPO offerings between 2017-2019 raising CAD ~$173M in March 2017 to fund the Phase III program and CAD ~$192M in Dec 2019 following successful Phase III data. The number of follow-on financings in 2020 to date has been high, however the average size of these rounds have been smaller. These offerings have provided for “buffer” capital to address potential delays caused by COVID-19, but have likely been smaller so as to limit dilution at lower valuations as stock prices have recovered from March lows.

To infinity and beyond

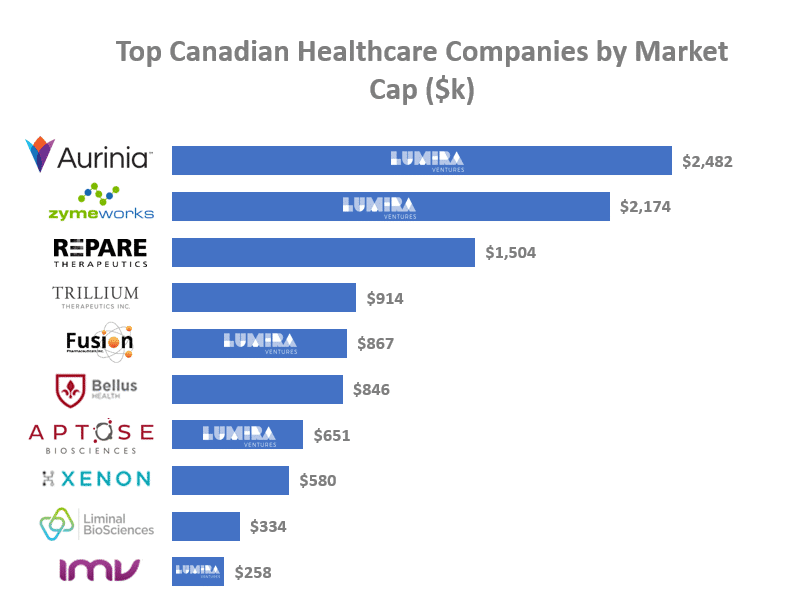

Note: As of June 30th, 2020

Canada has three notable healthcare unicorns (CAD $1B+ valuations) today in Aurinia, Zymeworks and Repare and these “proof-of-concept” success stories have put our life science innovation ecosystem on the world map. Tack onto these notable and recent acquisitions of Canadian companies Forbius by Bristol Myers Squibb (undisclosed amount in Sept 2020), BlueRock by Bayer (USD$600M in Aug 2019) and Clementia by Ipsen (USD $1.3B in April 2019) and you have all the makings of a thriving, self-sustaining healthcare industry.

These days many of the pitches the Lumira team hears from US healthcare companies seems to have some connection to Canada – to Canadian researchers or key opinion leaders, to Canadian clinical trial sites (and at times fully Canadian clinical programs), to Canadian management/talent and/or connections to our Canadian research institutions. Furthermore, US companies also recognize the benefits of tapping into this network as they seek to put together well-rounded syndicates. More and more, US VCs are recognizing this trend and are seeking participate.

Furthermore Canada’s response to COVID-19 (to be covered in a future edition of The Takeaway) has shown that we have the domestic talent, expertise and infrastructure to hold our own in times of health crises. COVID-19 has certainly served to bring healthcare and Canadian innovation in healthcare to the forefront as vaccines, testing/diagnostics, antivirals, antibodies, remote care/telemedicine (the list is endless) are now talked about our everyday lives. For better or worse, COVID-19 has served to accelerate healthcare trends that were already in progress (telehealth, remote care, next generation therapies, etc.) and highlight areas of need (rapid large-scale testing, manufacturing, and drug discovery, development, and testing). However, one thing is certain – there has never been a more opportune time to be a life science entrepreneur in Canada.

The Takeaway

- The Canadian innovation ecosystem, healthcare and otherwise, would not be strong as it is today without Provincial and Federal governments taking the initiative to invest back into early stage companies through Fund-of-Funds and proven high-performing VCs

- The number of VC rounds, IPOs/Direct listings/RTOs and follow-on financings for Canadian life science companies has been increasing since the mid-2010s with no reason to expect this will slow

- Canada now has its own “proof-of-concept” success stories in Aurinia and Zymeworks with others on the way

- There has never been a better time to be a life science entrepreneur in Canada